How to Start a Business for Foreign Companies in Dubai: A Step-by-Step Guide

Dubai, with its strategic location, world-class infrastructure, and business-friendly policies, has become a global hub for foreign companies looking to establish a presence in the Middle East. The city offers numerous advantages, including tax-free zones, a diverse economy, and access to international markets. This guide provides a comprehensive overview of how foreign companies can successfully start a business in Dubai.

Understanding the Dubai Market

Before establishing a business in Dubai, it is essential to conduct thorough market research. Dubai's economy is diverse, with strong sectors in finance, real estate, tourism, logistics, and technology. Understanding your target market, identifying key competitors, and assessing market demand are critical steps in developing a successful business strategy in Dubai.

Choosing the Right Business Structure

Foreign companies have several options when it comes to choosing a business structure in Dubai. The choice of structure will impact legal obligations, ownership rights, and operational flexibility:

- Free Zone Company: Setting up in one of Dubai’s many free zones is a popular option for foreign companies. Free zones offer 100% foreign ownership, tax exemptions, and full repatriation of profits. However, businesses in free zones are generally restricted from conducting direct trade within the UAE market unless they partner with a local distributor.

- Mainland Company (LLC): A mainland LLC allows businesses to operate anywhere in the UAE and participate in government contracts. However, foreign companies must have a local Emirati partner who holds at least 51% ownership. Recent reforms have allowed 100% foreign ownership in certain sectors, so it is essential to check the specific requirements for your industry.

- Branch Office: A branch office allows a foreign company to operate in Dubai without forming a separate legal entity. While it offers operational flexibility, the branch office is considered an extension of the parent company and is subject to local taxes on its income.

- Representative Office: A representative office is suitable for non-commercial activities such as market research or promoting the parent company’s products. It cannot engage in profit-making activities and is often used as a precursor to establishing a more permanent presence.

Navigating Legal and Regulatory Requirements

Starting a business in Dubai involves adhering to various legal and regulatory requirements. Key steps include:

- Company Name Registration: Choose a unique company name and register it with the Dubai Department of Economic Development (DED). Ensure that the name complies with Dubai’s naming conventions and does not infringe on existing trademarks.

- Business License: Depending on the nature of your business, you will need to obtain the appropriate license. Dubai offers several types of licenses, including commercial, industrial, professional, and tourism licenses.

- Office Space: Your company must have a physical office space in Dubai, which can be located in a free zone or on the mainland, depending on your business structure.

- Local Sponsorship: For mainland companies, a local sponsor or service agent is required. This sponsor will hold a minimum of 51% of the shares in the company unless your business falls under the exempt categories for 100% foreign ownership.

Understanding Taxation in Dubai

Dubai is known for its favorable tax regime, making it an attractive destination for foreign businesses. Key tax considerations include:

- Corporate Tax: Currently, there is no federal corporate tax on most businesses in Dubai, though the UAE government has announced plans to introduce a corporate tax starting in 2023. However, free zone companies may still enjoy tax exemptions depending on their activities.

- Value-Added Tax (VAT): Dubai imposes a 5% VAT on most goods and services. Businesses with an annual turnover exceeding AED 375,000 are required to register for VAT.

- Customs Duties: Importing goods into Dubai is subject to customs duties, typically at a rate of 5%, although certain goods may be exempt or subject to different rates depending on the trade agreements in place.

Hiring and Employment Regulations

Understanding Dubai’s labor laws is essential when hiring employees. Key considerations include:

- Employment Contracts: Employment contracts must be in writing and comply with the UAE’s labor laws. Contracts should clearly outline job roles, compensation, working hours, and other relevant terms.

- Work Permits and Visas: Foreign employees must have a valid work permit and residency visa to work in Dubai. The company is responsible for sponsoring these visas.

- Employee Benefits: Employers are required to provide certain benefits, including health insurance, annual leave, and end-of-service gratuity.

Cultural Considerations

Building a successful business in Dubai requires an understanding of local business culture. Dubai’s business practices emphasize respect, formality, and relationship-building. Networking and establishing strong relationships with local partners, employees, and customers are crucial for long-term success.

Leveraging Government Incentives

The Dubai government offers various incentives to attract foreign investment, including tax exemptions, grants, and favorable loan programs. Research free zone-specific incentives and government initiatives such as the Dubai SME 100 to determine what may be available for your business, particularly if you are in sectors like technology, innovation, or logistics.

Conclusion

Starting a business in Dubai presents significant opportunities for foreign companies, but it requires careful planning, legal compliance, and cultural understanding. By choosing the right business structure, navigating regulatory requirements, understanding the local tax system, and leveraging government incentives, your company can establish a successful presence in one of the Middle East’s most dynamic economies.

For additional guidance on expanding your business globally, check out our related articles: Starting a Business in China: A Comprehensive Guide for US and Other Foreign Companies, Starting a Business in India for US and Other Foreign Companies: A Step-by-Step Guide, How to Start a Business for Foreign Companies in the US: A Step-by-Step Guide, and How to Start a Business for Foreign Companies in Singapore: A Step-by-Step Guide.

Start the conversation

Become a member of Bizinp to start commenting.

Already a member?

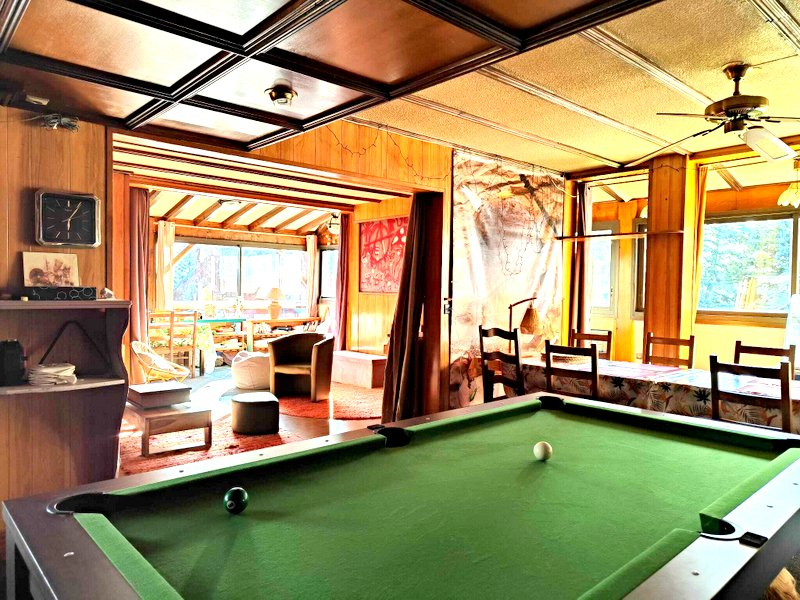

Small restaurant for sale in French Ski Resort

Great opportunity for people wishing to move to France on an entrepreneur visa. This small café/restaurant is located in the centre of one of France's most attractive ski resorts in the Pyrenees. It includes space for 40 diners, a fully-equipped professional kitchen and accommodation for the owner/manager. The very attractive price of €160,000 includes all the furniture and equipment as well as the agency fee: the business is ready to roll! More info directly from us at [email protected] There are two main seasons - Christmas through to end March (winter sports) and summer season from mid-June to the end of October (hiking, walking, nature clientele).